Fidelity is one of the oldest and most well-known brokerages in the U.S., with a long history and many fantastic features.

- Commission-free stock, ETF, and options trades

- Large selection of research providers

- User-friendly trading platforms

- High mutual fund fees

- Slow live chat

Fidelity Investments is one of the best brokerages in the business today because of its selection of investments, overall maintenance fees, and several services that make life easier for investors and traders.

If you are looking for a broker that can handle all of your markets and investments, Fidelity Investments is one of the best companies.

We’ve spent over 150 hours researching Fidelity, testing all sorts of tools, and checking its users’ feedback. Now you can see the results of our work below.

Fidelity – Who Are They?

Fidelity Investments was started by Edward C. Johnson II in 1946 and has grown to be one of the world’s largest brokerage firms. It is respected in the industry for its stability and selection of investment options.

Fidelity is a full-service brokerage that offers tools for all traders, from entry-level investors to seasoned experts. It offers a range of services, including a broad selection of investment products with no commission on stock, ETF, or options trades, and a selection of no-expense-ratio index funds.

Fidelity also offers an incredible range of research tools, along with detailed fundamental data. The quality of the news flow could be better, but there’s plenty to keep investors informed on the company’s situation.

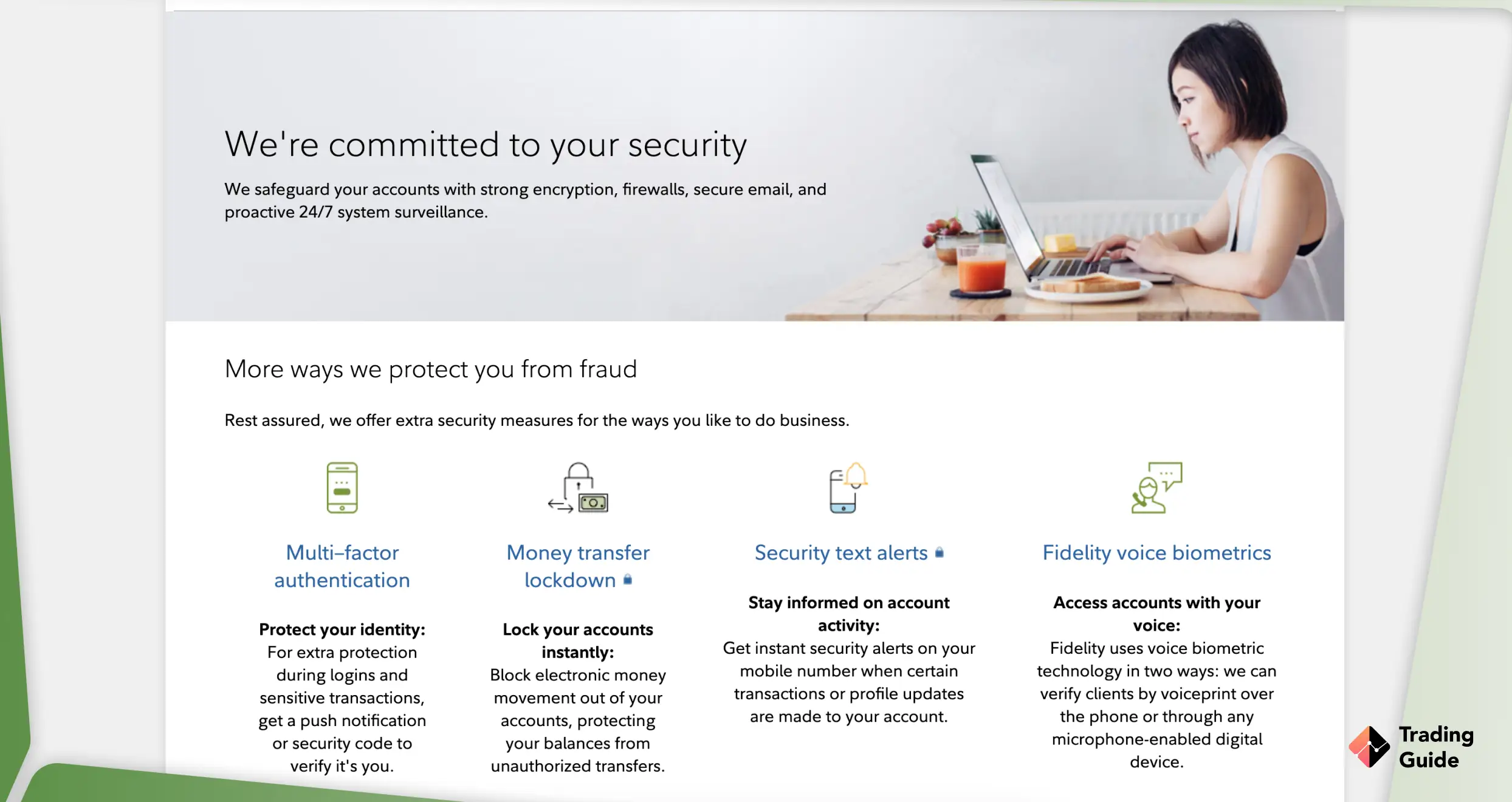

The fact that Fidelity is regulated by top-tier financial authorities and provides a high level of investor protection makes it a better broker than the vast majority of its competitors.

Compare Fidelity Features With Other Brokers

Compare brokers

Commissions and Fees

| Type | Fee |

|---|---|

| Minimum deposit | $0 |

| Overnight fee | $20 |

| Deposit fee | $0 |

| Withdrawal fee | $0 |

| Inactivity fee | $0 |

| Stock trading | $0 |

| Options | $0 |

| ETFs | $0 |

| Bonds and CDs | $0 |

Our Opinion About Fidelity

Our team spent a lot of time searching Fidelity and concluded that the company has a lot of positive qualities. We consider it absolutely safe to invest and trade with in the UK, as the Financial Conduct Authority strictly regulates it.

Fidelity also has solid educational materials. Newbies and experienced traders of all levels can learn a thing or two from its articles, webinars, and videos. There are many advanced trading strategies and forex-related topics featured in Fidelity’s educational tools.

FAQs

Absolutely. Fidelity has a lot of positive qualities, including numerous educational materials and research tools. The broker is also safe and secure since it complies with all FCA regulations.

In addition, Fidelity is registered with the US Securities and Exchange Commission (SEC). The fact that Fidelity is regulated by top-tier financial authorities and guarantees the security of your trading funds makes it a good broker.

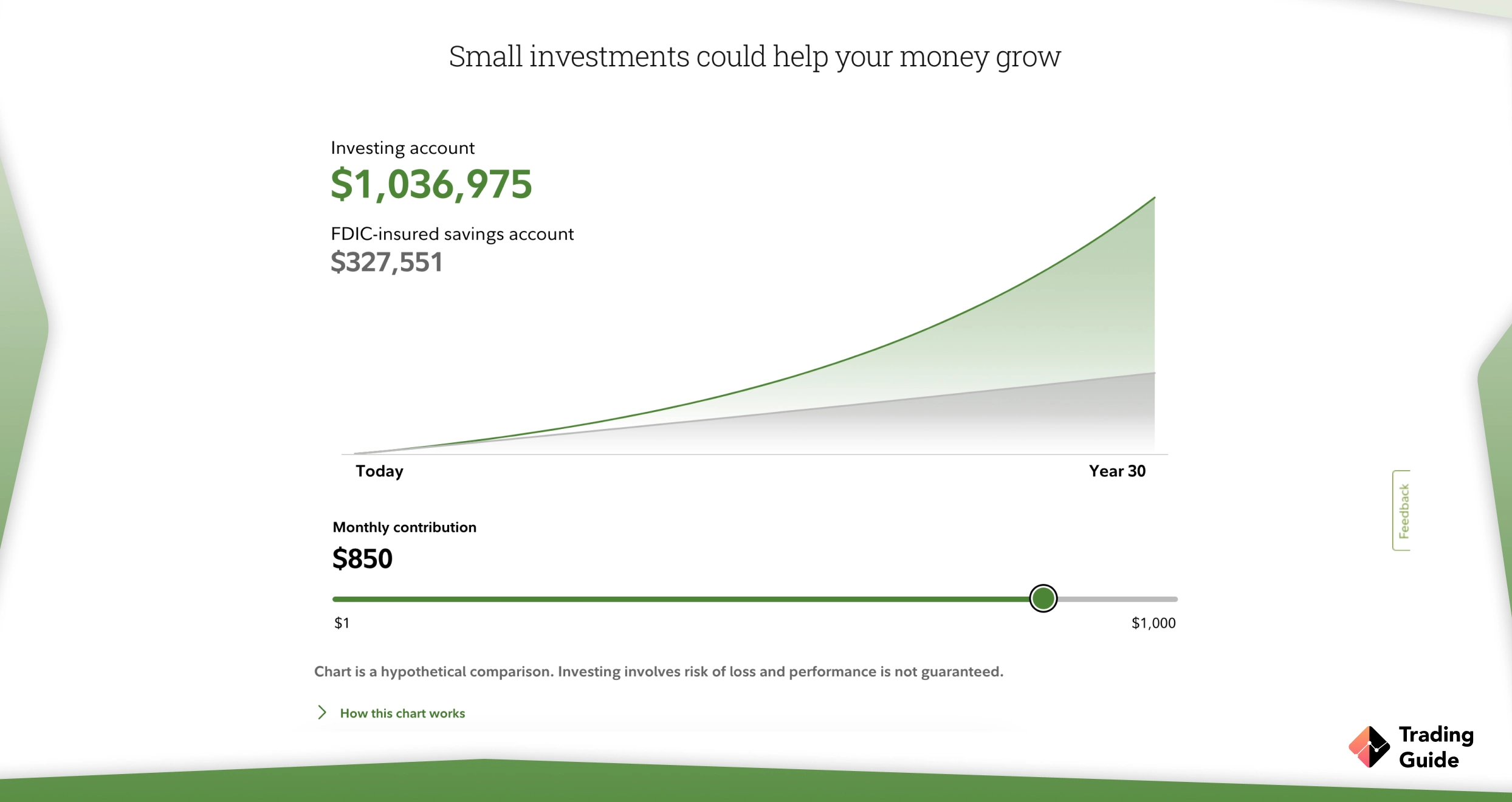

Fidelity has become so popular due to its commission-free trading model. The broker offers a wide selection of investment assets with no commission on stock, ETF, or options trades. With zero account minimums and a selection of no-expense-ratio index funds, Fidelity is one of the most affordable brokers in the financial space.

Yes. Fidelity is a trustworthy broker regulated by the FCA and SEC, meaning it has implemented measures to protect your money and personal information. For example, FCA regulations require brokers operating in the UK to store customer funds in segregated accounts. Fidelity cannot use these funds for anything other than facilitating your payment transactions.

No. Fidelity offers a cash management account among its portfolio of products. The account works similarly to a checking account. It comes with free standard checks, a debit card, mobile check deposits, and unlimited ATM fee reimbursements. However, it’s not a bank account and doesn’t have the same regulations other banks do.

My stock broker is Fidelity. If they go undo, what will happen to my portfolio which composes of 100% stocks and ETFs?

Most brokers pay the insurance that protects your capital and investments from a broker going out of business. Insurance doesn’t protect against losses you incur from buying a stock and its price declining thereafter.

I chose this broker because of the platform. The main advantages of MT4 are the following in security, functionality and availability of a tester! The platform uses a 128-bit encryption system based on a special algorithm. It is with a digital signature to protect the data. So even if a Trojan horse gets on your computer, the platform is tamper-proof. Also, It can be used to test manual and automatic strategies on historical quotes. So you can evaluate their effectiveness and record the results of a backtest for statistics. At first time, my profit was floating.. but it is normal for beginner traders. All comes with experience! So, today I received my money!!! Thanks Fidelity! I will suggest deposit and withdrawal through instant method.

I recently opened a brokerage account with Fidelity in less than 5 minutes. I downloaded their app and set up two-factor authentication and installed Active Trader Pro on my computer. I called customer service and the investment solutions group to initiate a transfer of funds from another IRA to my Fidelity account. Simple, fast and professional service!

I have been trading stocks with Fidelity in both brokerage and retirement accounts for I believe 20+ years. I have never had any real problems with any of their people and they have always been courteous, extremely helpful. I highly recommend it.

Very user friendly and straightforward website. My experience with this company was awesome and their services regarding trading are one of the best.

I've been a customer for 5+ years. My experience with Fidelity has been only positive. There are no fees, a great web interface, and an okay mobile app. I highly recommended Fidelity to my fellows. It's hard to imagine a better financial platform.

Happy with Fidelity as a brokerage so far. The app can be difficult to navigate as there is a lot going on and different sections have different layouts. The company is very responsive. I can't think of a better recommendation than that for a user-friendly app and platform. They have good customer service.

Great investing app. User friendly platform. The app provides an interface that is interactive and beautiful. Zero commissions. And the built-in trust with its longevity brings soothing comfort.

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal